Original author: Lao Bai

Original source: twitter

Note: This article comes from @Wuhuoqiu Twitter, and Mars Finance compiled it as follows:

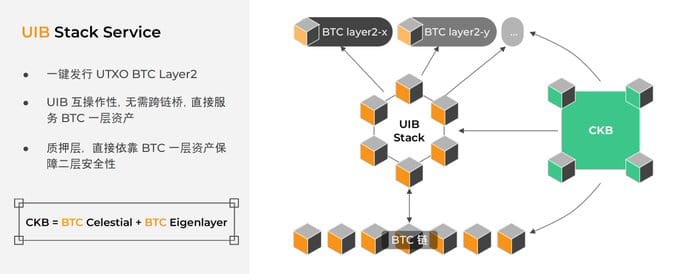

UTXO Stack, led by ABCDE, can technically help project developers issue BTC Layer2 based on UTXO architecture with one click, and natively integrate RGB++ protocol capabilities. In terms of security, it combines staking BTC, CKB and BTC L1 assets to ensure the security of Layer2.

Simply put, UTXO Stack is the "OP Stack + EigenLayer" of the Bitcoin ecosystem

1. BTC Layer2 dispute and RGB++

If you want to explain UTXO Stack clearly, you can’t avoid RGB++

There are more than 20 BTC Layer2s on the market, but most of them are EVM solutions, which basically use ETH's technology stack + bridge to solve BTC's expansion problem. Although the ecosystem can be quickly built in the short term, in the long run, this solution is not strongly bound to the BTC main chain in terms of security, and is heavily dependent on the bridge. Secondly, it is ideologically using ETH's Account model and EVM virtual machine to expand the UTXO of BTC, which seems somewhat not "Bitcoin Native" enough.

The Lightning Network has been running for many years but has not achieved the desired results. It also has the natural expansion shortcoming of not being able to support smart contracts. Solutions based on client verification paradigms such as Taproot and RGB also have many problems such as long implementation time and slow technological progress. This is also the main reason why the current EVM expansion solution is so popular.

Nervos, which has been deeply involved in the public chain field for many years, has used the natural structural advantages of POW+UTXO like BTC + innovative "isomorphic mapping" technology to "seamlessly migrate" RGB's client verification paradigm to CKB, named RGB++. It has greatly expanded its functions and flexibility at the expense of a little privacy, and its security is strongly bound to BTC L1. More importantly, RGB++ was actually launched a few days ago! This means that this is no longer a narrative of expansion that remains at the conceptual or development level, but a product that can actually start to build an ecosystem and solutions.

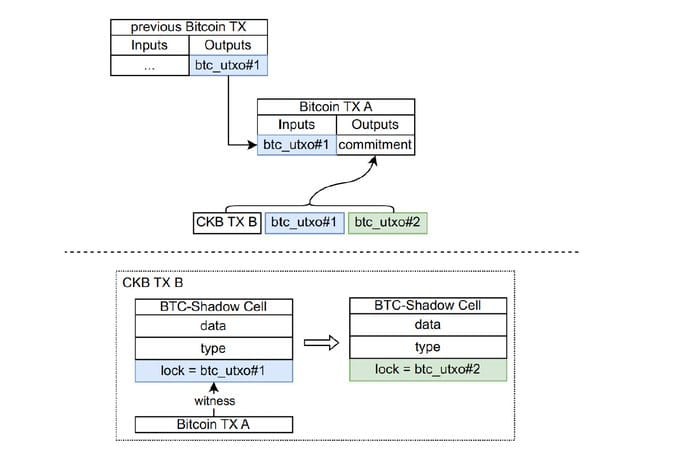

If the above terms like client verification and isomorphic binding are too abstract, then we can use the following analogy to understand RGB++ - a user initiates a transaction on BTC L1 to trigger the RGB++ asset transaction on CKB belonging to the user. When this transaction is completed on CKB, it is written back to the previous Commitment on BTC L1.

You may be wondering - this doesn’t save gas fees, right? Users still have to initiate transactions on BTC L1 and pay gas fees on BTC, but now they have to pay CKB’s gas fees as well. Does that make it more expensive?

In fact, there are four benefits:

1. RGB++, as an asset issuance protocol, enables BTC L1 to have the ability to issue new RGB assets (think of Merlin’s BRC420)

2. RGB++ asset transactions on CKB are fully Turing complete and programmable.

3. You can wait for multiple RGB++ transfers to be completed, and then aggregate and send a Commitment to Bitcoin L1. This is called "transaction folding". Doesn't it have a Rollup visual sense? This will save a lot of gas fees.

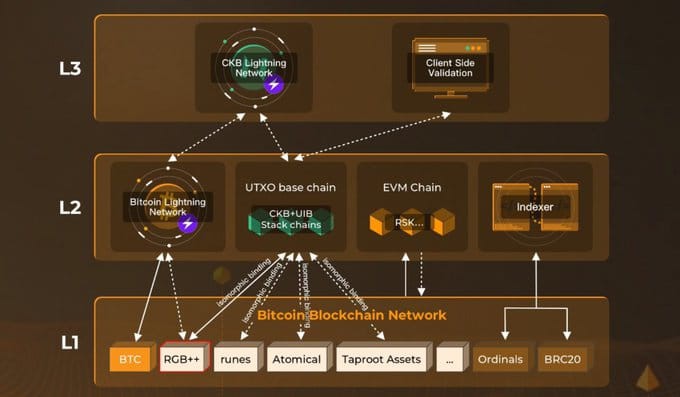

4. Not only RGB++ assets can be mapped to CKB, but also Atomical, Rune and other assets with UTXO characteristics can be mapped to CKB for Turing-complete transactions

Because only UTXO on Bitcoin L1 can operate or update RGB++ UTXO, in RGB++, CKB becomes the "execution + DA" layer of BTC, and BTC L1 becomes the true "settlement layer", which is currently impossible for any EVM and non-EVM BTC expansion plan to do.

What if you think this solution is not fast enough and the cost is not low enough? After all, transactions on BTC L1 are still inevitable, and the maximum TPS of CKB as a POW L1 is only a few hundred. Is there a more flexible and fast expansion solution, like... Appchain in the ETH ecosystem?

So we have UTXO Stack, the “OP Stack” based on BTC and RGB++

二. UTXO Stack - BTC的OP Stack+EigenLayer

If you are familiar with OP Stack and RAAS (Rollup as a Service) protocol stack, UTXO should be easy for you to understand.

With UTXO Stack, you can issue BTC’s isomorphic UTXO Appchain with one click, and these Appchains have the following features:

1. UTXO model, ultra-high TPS (UTXO inherently comes with parallel processing), ultra-low Gas fees

2. POS mechanism, security is provided by BTC/CKB pledged on BTC (similar to EigenLayer)

3. The asset protocol uses RGB++. Due to the existence of isomorphic mapping technology, assets can be transferred between Appchain/CKB/BTC at will without the need for a cross-chain bridge

4. CKB smart contract stack can be reused

5. BTC wallet can be reused (users are not aware of the CKB chain)

Finally, we have a Bitcoin-native, UTXO-based chain infrastructure. This infrastructure also integrates the Restaking concept proposed by EigenLayer. While better empowering BTC and CKB, it also protects the cold start and security of Appchain.

Finally, we have a Bitcoin-native, UTXO-based chain infrastructure. This infrastructure also integrates the Restaking concept proposed by EigenLayer. While better empowering BTC and CKB, it also protects the cold start and security of Appchain.

It is foreseeable that in the near future, BTC EVM layer2 and BTC UTXO layer2 will engage in a head-on confrontation at multiple levels, including technology, ecology, and even ideology.

It took less than two months from the official proposal of RGB++ in February to its implementation in April, demonstrating the team's extremely strong engineering capabilities. UTXO Stack was launched at the same time as RGB++, giving BTC ecosystem asset issuance and gameplay more diverse + Bitcoin Native possibilities. We believe and work with UTXO Stack to push the Bitcoin ecosystem towards a better and more prosperous future.