As 2024 approaches, the cryptocurrency space is making a groundbreaking comeback, delivering rich rewards to those who have weathered the latest bear market storm. This recovery is more than just a rebound in value;it’s a testament to the resilient and evolving nature of the crypto ecosystem. Determined investors, enthusiasts, and innovators are now at the forefront of a reinvigorated space, witnessing the birth of breakthrough ideas and the blossoming of cryptocurrency’s potential, turning it into substantial, innovative applications that go far beyond mere speculative assets.

a16z's 2023 Cryptocurrency Report

a16z's 2023 Cryptocurrency Report

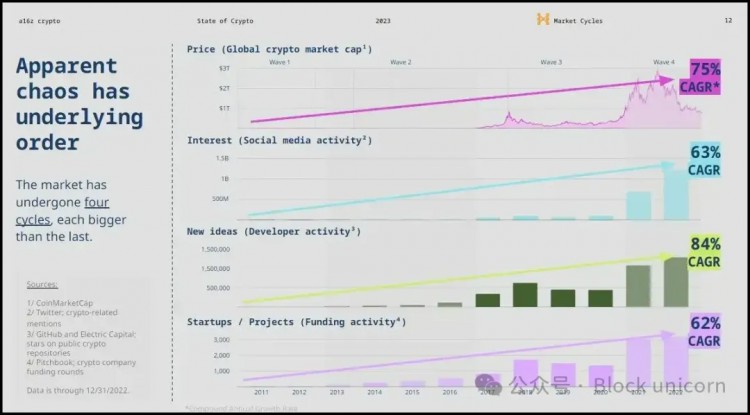

This vibrant recovery is supported by a striking infographic from a16z’s Crypto Report 2023, showcasing the booming interest in cryptocurrencies around the world. It’s not just prices that are rising; the influx of new ideas, an increase in startups, and a growing user base have seen a compound annual growth rate (CAGR) of between 63% and 84% since 2012. This strong growth narrative highlights the dynamic evolution of the cryptocurrency industry, its ability to rebound and push the boundaries of possibility, while ushering in a new era of innovation and opportunity.

This article dives into some of the most compelling new stories shaping the cryptocurrency space in 2024. From the transformative potential of decentralized finance (DeFi) to groundbreaking advances in the tokenization of real-world assets, the breadth of innovation is staggering. However, as we explore these frontiers, it is critical to approach them with a cautious eye. Many of these concepts, while promising, are still nascent, and their real-world applications have yet to be fully realized and tested. In addition, the evolving regulatory landscape introduces additional complexity and potential headwinds.

As we begin to explore the top cryptocurrency narratives, we must remain vigilant and recognize the endless possibilities, while also being mindful of the uncertainties and challenges that lie ahead.

Liquid Staking Tokens: Reshaping the Staking Dynamics

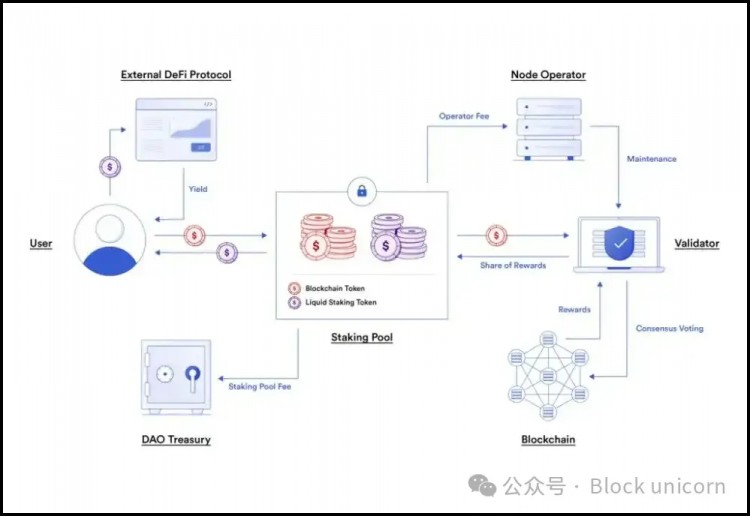

In the traditional staking model, participants lock up assets to support network operations and face liquidity constraints as a trade-off for earning rewards. Liquid staking has emerged as a game-changing innovation that solves this fundamental problem by allowing stakers to maintain liquidity while staking assets. This approach is increasingly in demand as it reconciles the benefits of staking with the flexibility of liquid assets, enabling participants to maximize operational efficiency and financial opportunities in the blockchain ecosystem.

Chainlink explains the liquidity staking mechanism

Chainlink explains the liquidity staking mechanism

The benefits and risks of liquidity staking

Liquidity staking brings several benefits that enhance the staking experience:

Enhanced liquidity: Stakers receive liquidity tokens representing their staked assets, enabling them to use them in various DeFi applications without giving up staking rewards.

Increased participation: Liquidity staking encourages broader participation in network security by lowering barriers to entry and increasing decentralization.

Flexibility and efficiency: Participants can respond quickly to market changes and use their liquidity tokens for trading, lending, and borrowing, thereby optimizing the utility of their assets.

However, these advantages also come with associated risks:

Smart Contract Vulnerabilities: Reliance on smart contracts introduces a layer of risk where flaws or vulnerabilities could result in loss of funds.

Market Volatility: The value of liquidity tokens may fluctuate, introducing an element of market risk not typically present in traditional staking.

Complexity and interdependence: Integrating various DeFi protocols will increase complexity and interdependence, potentially exacerbating systemic risks in the blockchain ecosystem.

Well-known liquidity staking projects:

Several notable projects are at the forefront of the liquidity staking movement and have had a significant impact on the Web3 landscape:

Lido: As a leader in the liquid staking space, Lido provides solutions across multiple blockchains, facilitating staking without locking up assets, thereby enhancing liquidity and participation.

Rocket Pool: Rocket Pool provides a decentralized, trustless staking service for Ethereum, promoting accessibility and network health.

These projects, and others, are leading the shift toward a more liquid, dynamic, and inclusive staking environment, fostering a robust Web3 ecosystem where participants can participate more freely, securely, and profitably. As liquid staking continues to evolve, it promises to redefine the staking paradigm, offering a powerful combination of security, liquidity, and opportunity that aligns with the fundamental principles of decentralization and user empowerment in the blockchain space.

The Restaking Revolution: A New Paradigm for Crypto Yields

A groundbreaking concept called “restaking” redefines the mechanics of blockchain security and token economics. Restaking is a sophisticated mechanism whereby a new blockchain network entrusts its economic security to a strong, professional security layer. This is achieved by accumulating liquid staking tokens and distributing them to the staking layer, thus ensuring enhanced protection and efficiency.

The "re" in restaking refers to a tiered commitment: resources are initially staked to secure a primary protocol like Ethereum, then allocated to another protocol, benefiting both tiers. This innovative approach simplifies security and fosters a more connected and cooperative blockchain ecosystem.

The impact of re-staking on the crypto economy

Restaking is a game changer for the crypto economy, especially for emerging first-layer networks. By eliminating the need for these networks to independently recruit validators and accumulate staking resources, restaking significantly reduces barriers to entry and operational overhead. The model promotes more efficient use of resources as staked assets can be leveraged across multiple protocols, thereby enhancing the overall security and vitality of the Web3 space.

Furthermore, the additional revenue stream generated through re-staking incentivizes new participants to join the ecosystem. This influx of stakeholders helps to create a more secure, robust, and decentralized Web3 environment, highlighting the transformative potential of re-staking.

Ethereum Staked on the Network | Chart from CryptoQuant

Ethereum Staked on the Network | Chart from CryptoQuant

How to participate in re-staking

Participating in re-staking requires a strategic approach and a deep understanding of the underlying platforms and mechanisms. Potential participants should first familiarize themselves with platforms such as EigenLayer and EtherFi, which are at the forefront of the re-staking movement.

The general steps involve acquiring Liquid Staking Tokens (LSTs) from platforms such as Lido Finance and pledging these assets to the chosen re-staking layer. By following this process, individuals and entities can contribute to the security and efficiency of multiple blockchain networks while also taking advantage of new channels to earn yield and participate in the digital asset space.

BRC-20 Tokens: Making Bitcoin Smarter

BRC-20 tokens represent a significant innovation, bringing a new utility layer to the Bitcoin blockchain. Unlike the Satoshi, which is the traditional base unit of Bitcoin, BRC-20 tokens introduce a novel concept by inscribing a JSON file onto individual Satoshis. This process is akin to attaching a unique digital annotation to each Satoshi, giving them unique properties and identity. These inscriptions can detail a variety of properties, including the name of the token, the token symbol, and the total supply, transforming the ordinary Satoshi into a versatile digital asset.

The serial number inscription is also a BRC-20 token

The serial number inscription is also a BRC-20 token

Overview of BRC-20 vs. ERC-20 Tokens

The creation of BRC-20 (like Ordinals) tokens differs significantly from the established ERC-20 standard on the Ethereum blockchain. While ERC-20 tokens leverage smart contracts to introduce new assets with properties independent of Ethereum, BRC-20 tokens take an inscription approach. To create a BRC-20 token, a specific amount of Bitcoin must be deposited into the Ordinals registry. These deposited Bitcoins will then serve as the backbone of the BRC-20 token, with the token supply corresponding to the deposited amount.

An interesting aspect of BRC-20 tokens is their operational framework, which enables them to run in parallel with the main Bitcoin blockchain. Therefore, transactions can be validated on the Bitcoin network while being rejected on the BRC-20 protocol if they fail to meet predefined inscription conditions.

The advantages of BRC-20 tokens include their simplicity and the strong security inherited from the Bitcoin blockchain. However, they also have some limitations. Their versatility is limited due to the lack of smart contract functionality, and their interoperability with other blockchain systems is relatively limited.

The future of BRC 20 tokens

Looking ahead, BRC-20 tokens are expected to usher in a new era for the Bitcoin network. From enabling direct peer-to-peer transfers to facilitating the creation of Bitcoin-based DeFi applications and tokenizing real-world assets such as gold and real estate, BRC-20 can significantly broaden Bitcoin’s use cases and open a new chapter in its storied evolution.

ERC 7621: Basket of Tokens Standard

ERC-7621 is a new token standard developed by Alvara Protocol. It is designed to create and manage on-chain multi-token asset portfolios and investment portfolios. It provides a framework for deploying token basket standards on the Ethereum blockchain. A single BTS token can encapsulate any combination of ERC-20 tokens, similar to mutual funds in traditional finance, facilitating on-chain fund management.

Alvara Protocol creates a basket of token standards | Image from Alvara Litepaper

Alvara Protocol creates a basket of token standards | Image from Alvara Litepaper

Key features and innovations

Basket Token Standard (BTS): A revolutionary approach that allows the creation of tokens consisting of a variety of base ERC20 tokens.

Transferability and Liquidity: BTS is made transferable by integrating with the ERC721 standard for ownership representation, enhancing liquidity and governance.

Fungible BTS LP Tokens: These are ERC-7621 LP tokens that represent holdings in baskets and can be used in various DeFi applications, increasing their utility beyond traditional fund holdings.

Dynamic Contributions and Withdrawals: The protocol allows LP tokens to be minted and destroyed on every contribution or withdrawal, in line with fund dynamics.

Management Fees and Rebalancing: ERC-7621 automates the allocation of management fees and facilitates portfolio adjustments, simplifying fund management.

Alvara Protocol: Leveraging ERC-7621

The Alvara Protocol leverages the ERC-7621 standard to provide a decentralized framework for creating and managing investment funds on the blockchain. With fund factories and marketplaces, Alvara enhances visibility and performance tracking of BTS with the support of its native ALVA and veALVA tokens, driving ecosystem participation and governance. The protocol democratizes fund management, ensuring an accessible and efficient meritocracy.

Note: ERC-7621 is an experimental token standard that has not yet been formally proposed as an Ethereum Improvement Proposal. As such, it has not yet been reviewed by the Ethereum community, so readers who plan to explore this new standard must take it seriously.

ERC-404: Semi-Fungible Tokens

ERC-404 is another experimental token standard developed independently by Pandora Labs. Ethereum supports the ERC-20 standard for creating fungible tokens and the ERC-721 standard for NFTs. Pandora Labs merged these concepts to create semi-fungible tokens, a solution very similar to fragmented NFTs.

The idea of ??semi-fungible tokens has been circulating in Web3 almost since the advent of NFTs. The idea specifies a situation where NFTs need to be jointly owned on the chain. Standard NFT tokens can only have one official owner at a time, and ERC-404 defines a standard that retains the "non-fungibility" of NFTs while retaining the liquidity of ERC-20 tokens.

How ERC-404 works:

ERC-404 tokens are both divisible and unique. When a newly minted ERC-404 token represents ownership of a virtual asset, the entire unit in a single address mints an NFT in your wallet. That address can then sell a portion of that token. Once an ERC-404 is divided, the protocol destroys the NFT. When an address collects enough portions of a partic