Original author: Mary Liu

Original source: Bitpush

On Monday Eastern Time, Bitcoin broke through the tepid and dull trend of the past week and broke through $54,000 strongly. It hit an intraday high of $54,965.26 and was once close to $55,000, setting its highest value in 15 months.

According to CMC data, as of press time, Bitcoin is trading at $54,460.00, up 5% in the past 24 hours.

The vast majority of the altcoin market has received a boost from Bitcoin. Ethereum rose more than 2% to close at $3,173.87; SOL rose more than 5%; ADA rose about 4%; Polygon's MATIC token rose 8%.

Cryptocurrency concept stocks soar. Cryptocurrency exchange Coinbase (COIN) and Michael Saylor-helmed MicroStrategy (MSTR) both gained 17% on the day. Large Bitcoin miners Marathon Digital (MARA) and Riot Platforms (RIOT) gained 22% and 15%, respectively.

With just three days left until the end of February, Bitcoin is on track for a 27% monthly gain.

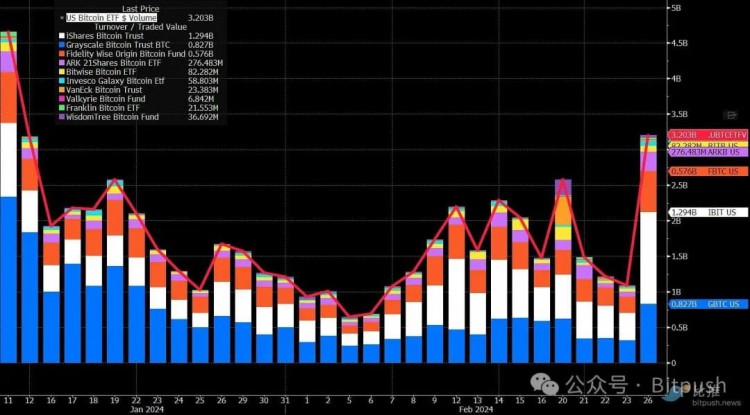

TradingView data shows that investors have also shown strong trading interest in U.S.-listed spot Bitcoin exchange-traded funds (ETFs), with BlackRock’s IBIT recording its largest daily trading volume (over $1 billion) since its listing. U.S. spot Bitcoin ETFs, including Grayscale GBTC, saw single-day trading volume of $3.2 billion, the second-highest ever.

Bitcoin price target for March is $63,000

The rise also comes with a higher premium for Bitcoin on Coinbase compared to other exchanges, suggesting demand is coming from U.S. investors.

Ryan Rasmussen, an analyst at Bitwise Asset Management, said: “Today is the settlement day for Bitcoin futures, which has caused the price increase we have seen. We are approaching a window where we typically see traders buying into Bitcoin before the halving. Be prepared, the halving will happen in the second half of April. I suspect this is the day people will start buying bullish positions before the halving.”

"Bitcoin has been hovering around $52,000 for the past two weeks, looking for a breakout," Oppenheimer analyst Owen Lau said.

JPMorgan analyst Nikolaos Panigirtzoglou pointed out in a recent report that after consolidating in January, retail interest in cryptocurrencies rebounded in February and became an important driver of price increases. He pointed to three key catalysts that help explain the new retail interest: Bitcoin’s halving and Ethereum’s next technical upgrade (both of which JPMorgan believes are already priced in) and the potential for a spot Ethereum ETF approve.

Today’s rally is a decisive breakout of one of the important resistance levels ahead of BTC’s record highs. Cryptocurrency analysis firm Swissblock said in a Telegram market update that “BTC now appears to have finally broken out of the stubborn range it has held since February 15th. Momentum is strong and everything is set to sail.”

The Swissblock analyst added that the next level for Bitcoin price targets is the $57,000 to $58,000 range, after which it will hit all-time highs.

Analysts at research firm Matrixport said the $63,000 Bitcoin price target they set in October 2022 by March 2024 is still achievable, especially given the timing of the next halving cycle.

Matrixport researchers wrote in a recent report: “Historically, Bitcoin has also tended to rebound on halvings, although the last halving cycle was hampered by post-COVID-19 stimulus injections from governments around the world. Serious impact."

Analysts say macroeconomic conditions are driving investors toward "safe-haven" assets. Some have pointed out that euro zone interest rate expectations are falling faster than U.S. interest rate expectations are rising, which will cause the euro to fall against the dollar.

Noelle Acheson, Crypto is Macro Now newsletter author, said: “A more permanent erosion of trust in the strength of the U.S. economy, given geopolitical trends, internal politics, and increasing pressures on the banking industry and job market, may encourage people to look more closely. Focus on 'uncorrelated' non-sovereign currencies such as Bitcoin and gold."

In the futures market, short open interest among CME hedge funds hit a record high of about $3.83 billion, according to CME data. However, long open interest held by asset managers, known as exchange-traded funds, also hit a record high of $3.58 billion.

Rebecca Stevens, senior research analyst at The Block, pointed out: “Both hit new highs in the week when the spot Bitcoin ETF was approved, and the trends were consistent with the price trend of BTC, but this shows that institutional bets on Bitcoin have not really been real after the launch. reduce."

Some technical analysts expect a pullback is coming.

Data firm CryptoQuant wrote in a blog post on Sunday: “On-chain data and Bitcoin price charts suggest that Bitcoin prices may see a correction in the coming weeks.”

The firm’s analysts base their forecasts on a metric called “Short-Term Holder SOPR,” short for “Spend Output Profit Margin,” which divides the current value of Bitcoin sold by its value at the time of purchase. CryptoQuant concluded: “It looks like Bitcoin could fall to the $48,000 area.”